If you’ve been trading for a while, you’ve probably heard the term liquidity thrown around a lot. But what does it really mean? And more importantly, how does it affect the way price moves in the market?

Let’s break it down in simple terms so you can start spotting liquidity traps and use them to your advantage.

What is Liquidity in Simple Terms?

Liquidity is all about where big money is sitting in the market. It’s the level where institutions have placed large orders, and retail traders have followed, hoping to ride the momentum.

But here’s the catch—these levels also happen to be where stop-losses cluster. And guess what? Big players love to hunt stop-losses before making their real moves.

Let me put it this way: imagine you buy at a support level because it’s been holding well. Where do you put your stop-loss? Just below that level, right? Now multiply that by thousands of traders. That creates a pool of liquidity that institutions can use to fuel price movements.

Liquidity isn’t about finding perfect trade entries. It’s about knowing where traders get trapped—and using that information to trade smarter.

Types of Liquidity You Need to Know

Liquidity comes in different forms, and understanding them can help you anticipate price movements instead of reacting to them. Here are some of the key ones:

1. Support and Resistance Liquidity – The Classic Trap

Support and resistance are the most basic concepts in trading, but they also create huge liquidity zones.

- When price hits resistance, institutions sell while retail traders try to short the market.

- When price finds support, institutions buy, and retail traders jump in too.

But here’s the trick—these levels act as magnets. They attract price back to them so liquidity can be absorbed. That’s why you often see price break through support or resistance, triggering stop-losses, before reversing in the opposite direction.

👉 Tip: Instead of blindly trusting support and resistance, ask yourself: “Where are the stop-losses resting?” That’s where liquidity is, and that’s where price is likely to go.

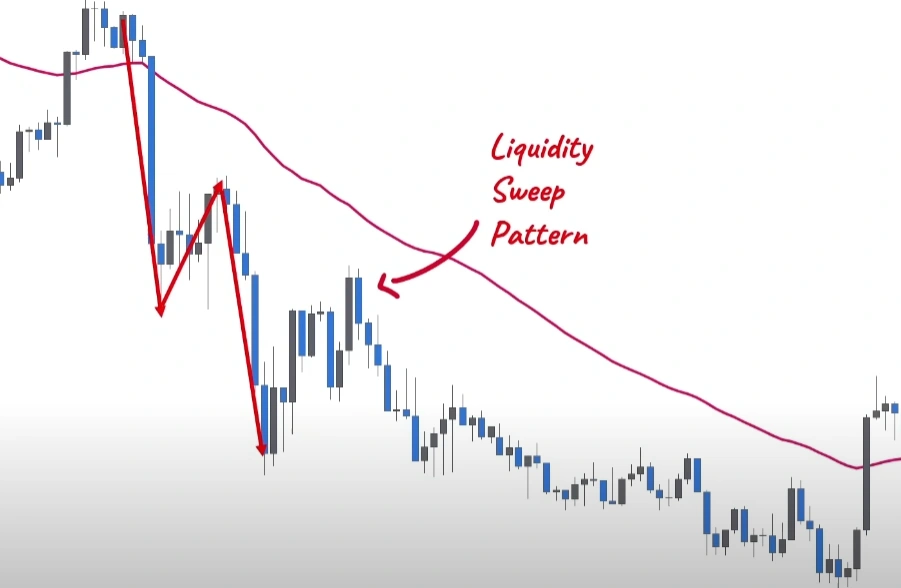

2. Trendline Liquidity – The False Sense of Security

If you’ve ever drawn trendlines and relied on them for trades, you might have noticed something frustrating:

💡 Price loves to break trendlines just to mess with traders.

Why? Because liquidity rests below trendlines in an uptrend and above trendlines in a downtrend. When too many traders use trendlines as support or resistance, institutions take advantage by pushing price beyond the trendline to trigger stop-losses.

👉 Tip: If you’re trading with trendlines, expect liquidity to be taken out before the real move happens.

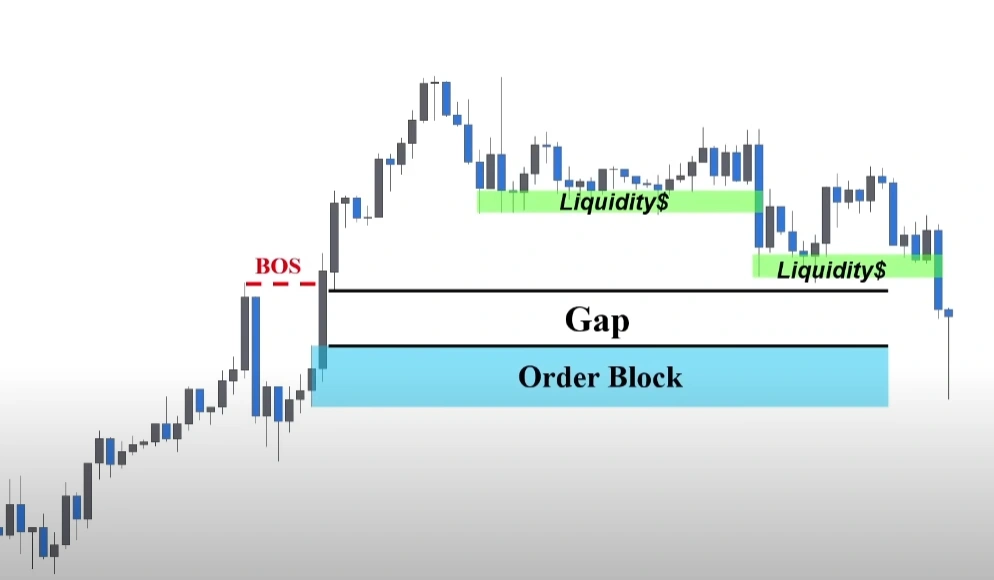

3. Failed to Break Liquidity (FTB) – The Perfect Bait

Have you ever seen price reject a level, making it look super strong, only for it to later break through like butter? That’s FTB liquidity in action.

Here’s how it works:

1️⃣Price reaches a supply or demand zone and aggressively rejects.

2️⃣ Retail traders take the bait, thinking the level is valid.

3️⃣ They place stop-losses just beyond the swing high or low.

4️⃣ Institutions push price past this level, taking their liquidity before moving in the real direction.

👉 Tip: If a level rejects too aggressively, don’t blindly trust it. Instead, watch where the stop-losses are and wait for price to take out liquidity before committing to a trade.

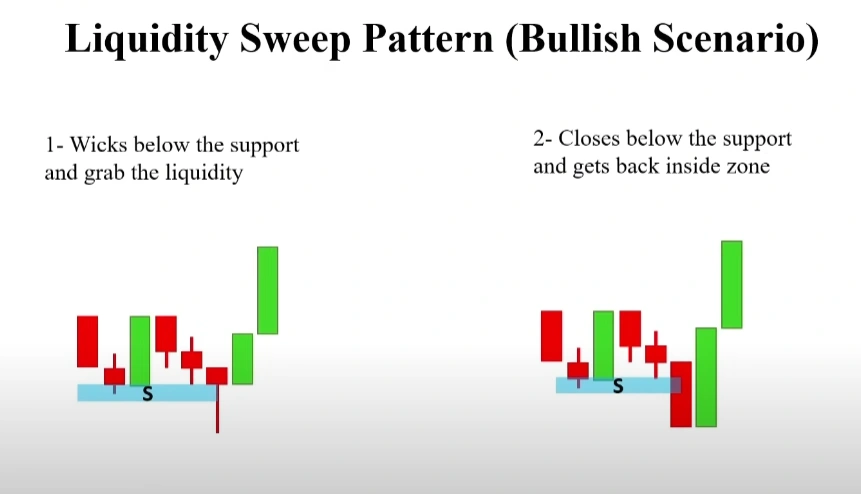

4. Failed to Close Liquidity (FTC) – The Sneaky Wick Trick

This one is subtle but deadly. FTC happens when price wicks beyond a level but never closes past it.

Traders assume the wick is a breakout and enter trades, but since the candle never closes beyond the level, it was just a liquidity grab. Price often reverses right after, leaving breakout traders trapped.

👉 Tip: Always wait for a candle close beyond key levels before assuming a breakout is real.

The Real Reason Liquidity Matters

Here’s the most important thing you need to understand about liquidity:

📌 Price is drawn to liquidity like a magnet.

Markets aren’t just random. Institutions push price to areas where they can fill large orders, and those areas are usually where retail traders’ stop-losses are clustered.

That’s why sometimes, price moves in the “wrong” direction before making the actual move—it’s clearing liquidity first.

So what happens after liquidity is absorbed?

Once liquidity is taken, price has two choices:

✅ It can continue trending (because enough liquidity has been absorbed to fuel the move).

❌ It can reverse sharply (because the move was a trap to trigger stop-losses).

Either way, understanding liquidity can help you avoid getting trapped and position yourself for higher probability trades.

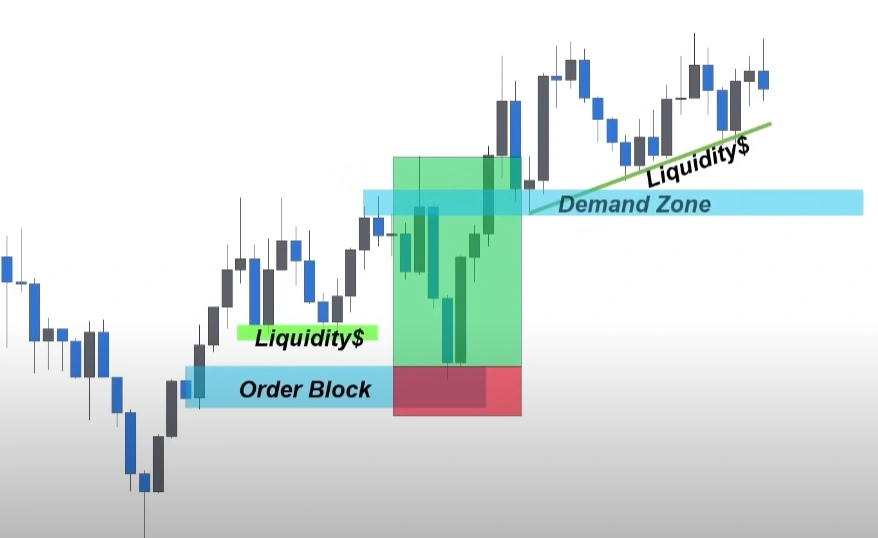

Inducement: The Market’s Trick to Force Bad Trades

Inducement is when the market tries to make you enter too early.

Here’s a common scenario:

1️⃣ Price is approaching a strong demand zone.

2️⃣ Instead of touching the zone, it reverses just before reaching it.

3️⃣ Traders think they missed the move and FOMO into a trade.

4️⃣ But then, price comes back down, actually hitting the demand zone and taking out early buyers before reversing.

Sound familiar? That’s inducement.

👉 Tip: Always wait for price to fully reach your area of interest instead of jumping in early. The market is designed to trick impatient traders.

How to Use Liquidity to Your Advantage

So, now that you understand how liquidity works, how do you actually trade it?

Here’s a simple step-by-step approach:

1️⃣ Identify Liquidity Zones – Look for areas where stop-losses are likely resting (support, resistance, trendlines, swing highs/lows).

2️⃣ Wait for the Liquidity Grab – Don’t enter blindly. Let price take out liquidity first.

3️⃣ Watch for Confirmation – After liquidity is taken, see if price reverses or continues trending.

4️⃣ Enter on the Retest – If price shows confirmation, enter after the liquidity sweep.

This approach helps you avoid stop hunts and trade with the institutions, not against them.

Final Thoughts: Liquidity is the Key to Smart Trading

Most traders lose money because they don’t understand liquidity. They place stop-losses in obvious places and get frustrated when the market “magically” takes them out before moving in their original direction.

But now, you know better.

✅ Liquidity zones act as magnets for price.

✅ Institutions target stop-losses to fill large orders.

✅ Trendlines, support, and resistance are not as reliable as they seem.

✅ Inducement tricks traders into entering too early.

Instead of fighting liquidity, use it to your advantage. Wait for liquidity grabs, be patient with your entries, and trade with confidence.

The market isn’t random—it’s engineered to take advantage of traders who don’t understand liquidity. Now that you do, you can start making better trading decisions. 🚀

Hridoy has been deep into the crypto world since 2019, starting with airdrops and later diving into trading and investing. Despite his experience, he still loves the thrill of free mining and believes in helping others earn from it too. Through his insights, he aims to make crypto accessible to everyone.